Since the days of Richard Normann, the guy who invented the business term ‘Moments of Truth’ and Jan Carlzon’s book in 1989, the business world has interpreted Moments of Truth in several ways.

I have also published many articles and conference keynotes (see the MOT primer below) reviewing the continued evolution of this fascinating concept.

Definitions

What is a Moment of Truth?

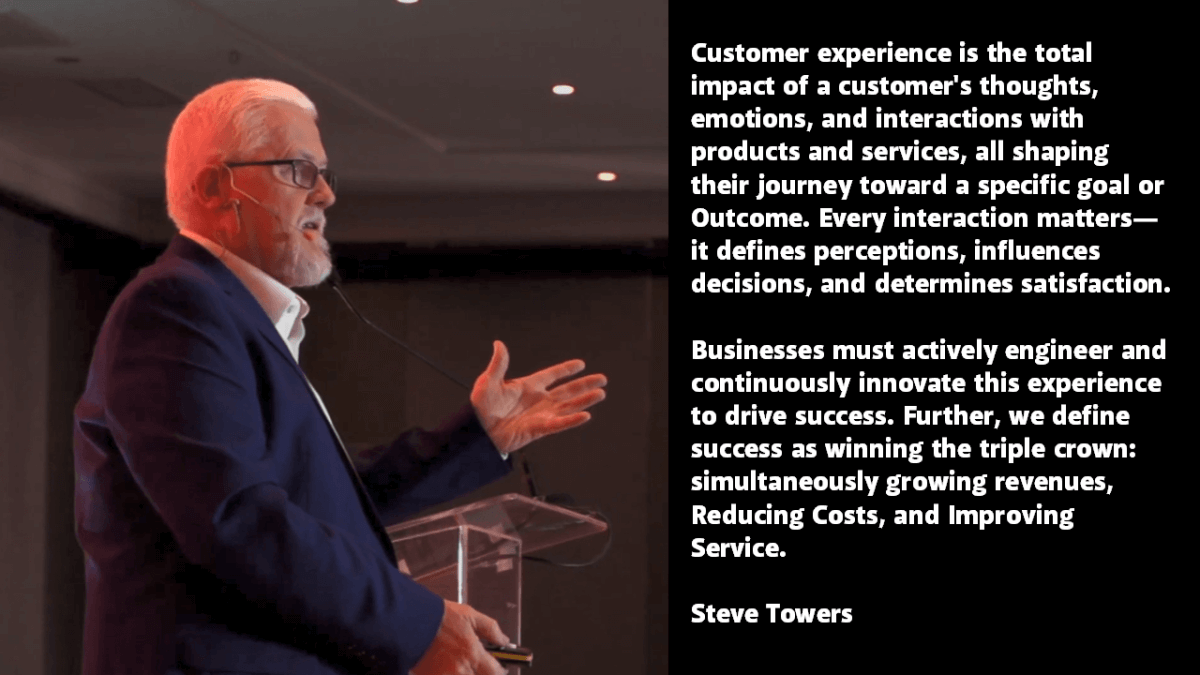

A Moment of Truth is any interaction with the customer within the Customer Experience, first discussed in my 1993 book ‘Business Process Reengineering – A Senior Executive’s Guide‘

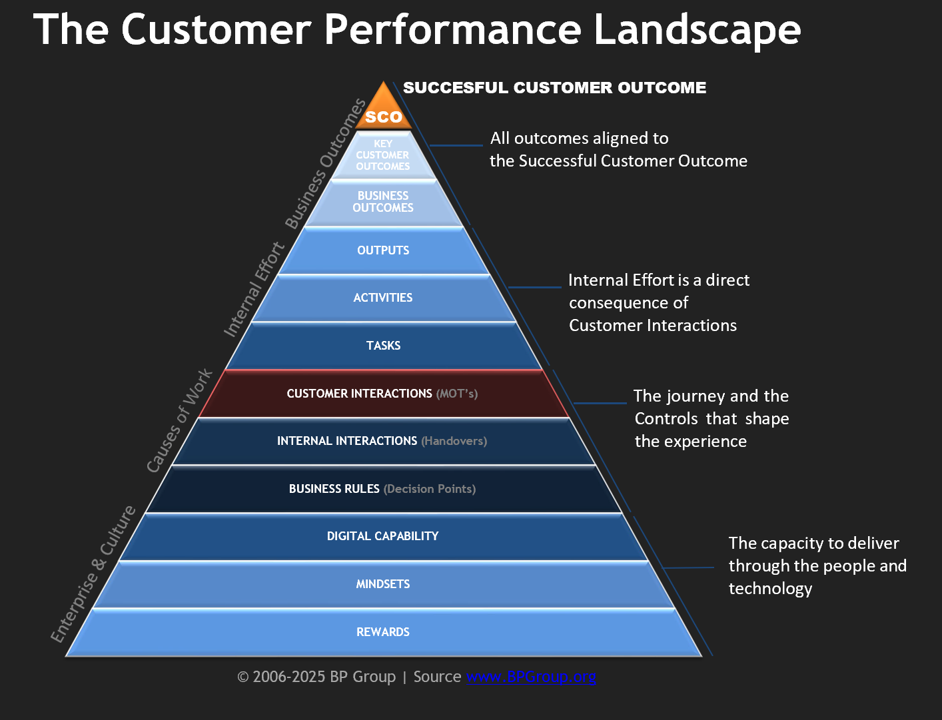

Moments of Truth are the cause of all work.

This understanding underpins the CEMMethod, first launched in 2006 and now in version 15. It is the idea that all work an organization undertakes is, at a fundamental level, caused by Moments of Truth. In principle, everything a company does can and should be linked to a Moment of Truth.

Managing Moments of Truth

Enlightened ‘Outside-In’ organizations actively embrace Moment of Truth Management as an essential strategic and operational necessity to deliver engineered Customer Experiences. How so?

a. Designing for Moments of Truth – The Design-Implementation Gap

Early efforts were geared around designing optimal Moments of Truth, however, simply mapping customer journeys has never been enough. It is one thing agreeing on what a future state customer journey should be, it is entirely another implementing it. This Design-Implementation gap is precisely what kills the majority of Customer Experience initiatives.

b. Implementing optimized Moments of Truth

Successful deployment of innovated Moments of Truth is key to delivering optimal Customer Experiences. The most practical immediate results are focused on rapid roll out across a key experience and using the success of that to validate rolling out smoothly across the organization. Establishing ownership, accountability, metrics, controls and improvement paths are part of this discipline.

c. Operationalizing Moments of Truth

Once Moments of Truth have been designed, innovated and implemented into recrafted customer experiences they need to be actively managed ‘in the moment’ and shared. Every Moment of Truth should feed to a corporate dashboard, with real-time data showing the performance of that MOT and its associated experiences. If things go wrong, the owner should be able to ‘course correct’ and real-time monitor the customer experience delivery.

Imagine a world without customer satisfaction surveys, no need for Net Promoter Scores, no focus groups, and no mystery shopping because you will know how 100% of interactions are performing 100% of the time.

Control and Action combined

The C suite and leaders will now have a clear line of sight into every corner of the organization and across the enterprise landscape REAL TIME. One version of the data truth (and not all those departmental/divisional versions of reality).

The need for retrospective action evaporates. Immediate and laser-focused control can be maintained delivering simultaneously enhanced service, lower costs, higher revenues, improved compliance and uber motivated employees.

What’s next?

In my next piece, I will demonstrate how this can be done immediately. If you can’t wait for that, ping me and let’s talk the how, now

MOT primer…

Steve Towers

https://www.linkedin.com/in/stevetowers/

Richard Normann – creator of the Moments of Truth concept:

https://en.wikipedia.org/wiki/Richard_Normann

Jan Carlzon – author of ‘Moments of Truth’

https://en.wikipedia.org/wiki/Jan_Carlzon

Moments of Truth 2025 (VIDEO)

https://youtu.be/3mzz_LdgmFY

That Kodak Moment of Truth

https://www.processexcellencenetwork.com/innovation/columns/4-lessons-from-the-kodak-moment-of-truth

Mitch Belsley – Get Scientific about Managing Moments of Truth

http://customerthink.com/get-scientific-about-managing-moments-of-truth/

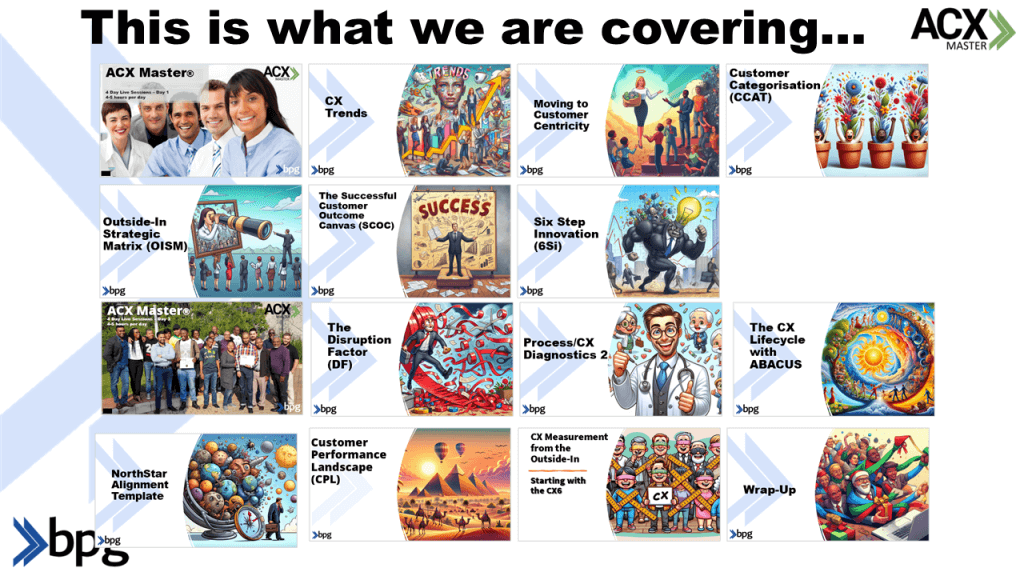

Accreditation & Certification in CX and Process

https://www.bpgroup.org